Introduction

Assets must be removed from the financial records as part of the disposal process. To entirely erase every trace of an asset first from the balance sheet is required (known as derecognition). In the fiscal quarter in which the asset disposal occurs, a gain or loss may need to be recorded on the transaction. We'll assume that the item sold is a fixed asset for the sake of this discussion.

During their valuable lives, one can sell the business's assets at any moment. An asset does not have to be kept until it is destroyed. one must make accounting records about the disposal of an asset. The asset may bring in a profit or a loss when sold. Let's examine the accounting impact of the same.

How to Record the Disposal of Assets?

The basic idea behind asset disposal accounting is to reverse the fixed asset's reported cost and the associated depreciable amount. Any residual discrepancy is recorded as a gain or a loss, depending on how much remains between the two. The net disposal revenues are subtracted from the asset's carrying value to determine the gain or loss.

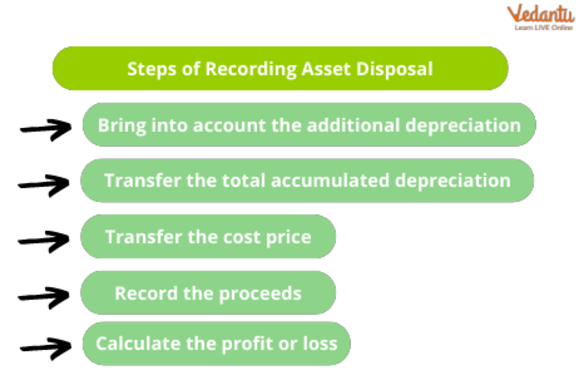

The choices for recording asset disposal are shown below. From the standpoint of keeping a clean financial statement, thoroughly fixed asset disposal is essential so that the reported balances of capital assets and cumulative depreciation accurately represent the assets that a corporation truly owns.

As part of the disposal procedure, assets must be deleted from the financial records. This is necessary to altogether remove all references to an asset from the balance sheet (known as derecognition). The transaction may require recording a gain or loss in the fiscal quarter in which the asset disposal occurs. For the sake of this discussion, we'll assume that the thing being sold qualifies as a fixed asset.

Record the Disposal of Assets

Loss on Sale of Fixed Assets

A depreciable asset can be sold or disposed of both before and beyond the end of its useful life. Asset disposal may occur during the asset's useful life owing to obsolescence or other circumstances.

The selling revenues from an asset sold after it reaches the end of its useful life should be credited to the asset account. One should record any profit or loss from the sale or disposal of the item in the profit and loss account.

One should assess depreciation for the time the asset is utilized in the year of sale when it is sold while still within its useful life. The provision of depreciation is moved to the asset account in cases when the provision on the depreciation account is maintained.

Loss on Sale of Fixed Assets

Journal Entry for Sale of Assets and Profit on the Sale of Asset

Journal Entry for Profit on the Sale of Asset

Debit all accrued depreciation, credit the fixed asset, and credit the gain on sale of asset account when there is a gain on the sale of a fixed asset. One should also debit cash for the amount received.

For instance, ABC International spends 50,000 dollars on a machine and records $5,000 in depreciation over the subsequent ten years. When the machine completely depreciates at that point, ABC gives it away and makes the following entry.

The number of fixed assets that grow due to an addition or loss on the sale of fixed assets is treated as. The money spent on a fixed asset is considered capital expenditure.

Disposal of assets means the elimination of a long-term asset from the company's accounting records, which is known as the disposal of assets. It is crucial since capital assets are necessary for profitable business operations. Furthermore, keeping up-to-date and accurate accounting records depends on correct accounting of asset disposal. The sale of the asset might be the outcome of numerous things:

When fully depreciated, an asset needs to be disposed of

Because an asset is no longer required or helpful, it is sold.

Unexpected events force the removal of an asset from the books (e.g., theft).

The sale of the asset has an immediate impact on the company's financial statements. In every case, the removal of a capital asset has an impact on the balance sheet.

Additionally, the income statement must show the profit or loss and whether a business sells assets for profit or loss. The loss on the sale of an asset is debited to the profit and loss account

Depreciation on the Sale of Asset

Depreciation is a method used by corporations to divide the cost of fixed assets, such as structures, machinery, equipment, and furnishings, over the years one will use the assets.

The majority of organisations depreciate assets using the straight-line technique for accounting purposes.

Subtract the asset's cost from its salvage value (what you anticipate to be worth at the end of its useful life) to determine depreciation using the straight-line technique. The outcome is the amount that may be depreciated or the depreciable basis. Subtract this sum from the asset's useful life, measured in years. For example, you may calculate the asset's monthly depreciation by dividing by 12.

Depreciation on Sale of Assets

Conclusion

Asset disposal includes removing them from the books. This is necessary if an asset is eliminated from the books entirely (known as derecognition). An asset sale may necessitate a gain or loss in the fiscal quarter of the sale. We'll assume the sold item is a fixed asset for this discussion.

Asset disposal accounting involves reversing both the reported cost and accrued depreciation. Any difference is a gain or loss. Net disposal revenues minus the asset's carrying value determines gain or loss.

FAQs on Depreciation Accounting: Sale of Part of an Asset

1. What is the basic accounting process for the sale of a part of a fixed asset?

When a part of an asset is sold, the accounting process involves isolating the portion being sold from the main asset. The key steps are:

- First, calculate the book value (original cost less accumulated depreciation) of the specific part being sold.

- Next, charge depreciation on this part from the beginning of the accounting year up to the date of sale.

- Then, transfer the updated book value of the sold part to an Asset Disposal Account.

- Record the sale proceeds and calculate the final profit or loss on the transaction.

- Finally, calculate and record depreciation for the full year on the remaining part of the asset that was not sold.

2. How is depreciation calculated when only a portion of an asset is sold mid-year?

Calculating depreciation in this scenario involves two separate calculations:

- For the part sold: Depreciation is calculated on the book value of the sold portion for the period it was used during the year (from the start of the year until the date of sale).

- For the remaining part: Depreciation is calculated on the book value of the portion that is retained by the business for the entire accounting year.

The total depreciation for the year is the sum of these two amounts. This ensures that the depreciation expense is accurately matched with the asset's usage.

3. What are the essential journal entries for recording the profit or loss on the sale of a part of an asset?

To record the sale and the resulting profit or loss, the following journal entries are typically passed:

- To transfer the book value of the sold part: Debit the Asset Disposal A/c and Credit the main Asset A/c with the book value of the part being sold.

- To record the sale proceeds: Debit the Bank/Cash A/c and Credit the Asset Disposal A/c with the amount received from the sale.

- To record a profit on sale: If the sale proceeds are more than the book value, the difference is a profit. Debit the Asset Disposal A/c and Credit the Profit & Loss A/c.

- To record a loss on sale: If the sale proceeds are less than the book value, the difference is a loss. Debit the Profit & Loss A/c and Credit the Asset Disposal A/c.

4. Can you provide a simple example of accounting for the sale of a part of an asset?

Imagine a business bought four identical machines for ₹2,00,000 in total (₹50,000 each). After two years, the total accumulated depreciation is ₹40,000 (assuming 10% SLM). The book value is ₹1,60,000. If one machine is sold for ₹32,000, the accounting would be:

- Book Value of one machine: ₹40,000 (Original Cost ₹50,000 - Depreciation ₹10,000).

- Sale Entry: The machine's book value (₹40,000) is moved to an Asset Disposal Account. The sale proceeds (₹32,000) are recorded.

- Calculate Loss: Since the book value (₹40,000) is more than the sale price (₹32,000), there is a loss of ₹8,000 on the sale.

- Depreciation on Remaining Assets: The business continues to charge depreciation on the remaining three machines (costing ₹1,50,000).

5. Why is it necessary to create a separate 'Asset Disposal Account' when selling a part of an asset?

Using an Asset Disposal Account is a standard accounting practice that provides clarity and control. Its importance lies in:

- Isolation: It isolates all transactions related to the disposal (book value, sale price, expenses on sale) from the main Asset Account. This keeps the main asset ledger clean and focused only on assets currently in use.

- Accurate Calculation: It acts as a temporary ledger to easily and accurately calculate the profit or loss from the sale. By comparing the total debits (book value) and credits (sale proceeds) in this account, the balancing figure reveals the exact gain or loss.

- Clear Audit Trail: It provides a clear and transparent record for auditors, showing the complete history of the asset's disposal in one place.

6. How does the accounting for the sale of a part of an asset differ between the Straight-Line Method (SLM) and the Written-Down Value (WDV) method?

The fundamental process is the same, but the calculation of book value and depreciation differs significantly:

- Under SLM: The cost of the part being sold is easily identifiable, and its accumulated depreciation is calculated based on this original cost. The calculation is straightforward as depreciation is uniform each year.

- Under WDV Method: This is more complex. You must calculate the specific written-down value of the part being sold, year by year, up to the date of sale. The depreciation on the remaining asset is then calculated on its own separate written-down value. It requires careful tracking of the book value for each component separately, even if they were bought together.

The key difference is the complexity in determining the book value of the sold portion under the WDV method.

7. What is the nature of the 'Profit or Loss on Sale of Asset' account and where is it presented in the final financial statements?

The 'Profit or Loss on Sale of Asset' is a nominal account because it represents an income (gain) or an expense (loss) for the business. Its treatment in the financial statements is as follows:

- A profit (gain) on the sale of an asset is considered an indirect income. It is shown on the credit side of the Profit and Loss Statement.

- A loss on the sale of an asset is treated as an indirect expense. It is shown on the debit side of the Profit and Loss Statement.

This final transfer ensures that the impact of the asset disposal is correctly reflected in the company's overall profitability for the accounting period.