CBSE Chapter 6 Open Economy Macroeconomics Class 12 Notes PDF - FREE Download

FAQs on Open Economy Macroeconomics Class 12 Notes: CBSE Economics Chapter 6

1. What are the most important terms and definitions to remember from Open Economy Macroeconomics Class 12 Revision Notes?

Key terms to focus on include open economy, balance of payments (BOP), current account, capital account, foreign exchange rate, balance of trade (BOT), devaluation, revaluation, autonomous transactions, and accommodating transactions. Learning these core definitions creates a strong foundation for understanding the entire chapter as required by the CBSE 2025–26 syllabus.

2. How should you structure your quick revision for Open Economy Macroeconomics in Class 12?

Begin with basic concepts such as international trade and exchange rates, then progress to the balance of payments and its sub-accounts. Use a concept map to link major ideas, such as how trade policies impact currency values and economic interactions, following the sequence of the chapter for efficient last-minute revision.

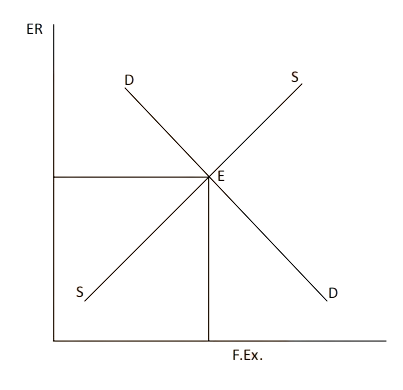

3. Why is understanding exchange rate mechanisms critical when revising this chapter?

Exchange rate mechanisms dictate how currencies are valued in global markets, impacting international trade, capital flows, and economic stability. A clear grasp of flexible, fixed, and managed floating systems allows students to analyze both direct exam questions and real-world economic scenarios, a core requirement for higher-order thinking in CBSE Economics.

4. What is the ideal approach to revising the balance of payments using revision notes?

Focus on separating the current account (covering trade in goods, services, and transfers) from the capital account (documenting capital movements and investments). Use tables or flowcharts to visualize the distinctions. Practice applying these concepts to sample scenarios to reinforce understanding, a key for fast and effective CBSE revision.

5. How can you use concept maps to improve retention of topics in Open Economy Macroeconomics?

Concept maps connect related terms (like trade flows, exchange rate types, and capital account elements), helping visualize cause-effect relationships and see how one topic impacts another. They are valuable tools for summarizing complex information at a glance, which is especially beneficial during revision sessions before exams.

6. What common errors do students make when revising fixed and flexible exchange rate systems?

Many students mistakenly assume fixed exchange rates always stabilize an economy and flexible rates always cause volatility. In reality, fixed rates require significant reserves and can mask currency misvaluations, while flexible rates adjust automatically and can help solve external imbalances. Clarifying these misconceptions can lead to more accurate answers in board exams.

7. How does the revision notes format assist with solving higher-order application questions in CBSE exams?

Structured revision notes highlight interconnections between core ideas—such as the impact of currency devaluation on trade balances or how capital flows affect the balance of payments. This approach encourages analytical thinking and equips students to confidently address complex application-based and HOTS (Higher Order Thinking Skills) questions.

8. What role do autonomous and accommodating transactions play in understanding BOP adjustments during revision?

Autonomous transactions arise from economic activities that are independent of balance of payments needs, while accommodating transactions are specifically undertaken to correct BOP imbalances. Understanding these distinctions is essential for analyzing how economies manage deficits or surpluses during global interactions.

9. Which strategies enhance last-minute revision for Open Economy Macroeconomics Class 12?

Summarize each section’s main points, review flowcharts and concept maps, and focus on keywords like trade policies, exchange rates, and capital inflows. Prioritize practicing problems and applying concepts to real or hypothetical scenarios. Highlight persistent challenges or commonly confused terms for targeted review before the exam.

10. How do international events connect to the concepts in Open Economy Macroeconomics revision notes?

Real-world events—such as trade wars, currency crises, and global recessions—impact exchange rates, capital flows, and balance of payments positions. Drawing connections between textbook concepts and these events deepens your understanding and helps anticipate the types of application questions appearing in the CBSE exam.