What is the LIFO Method?

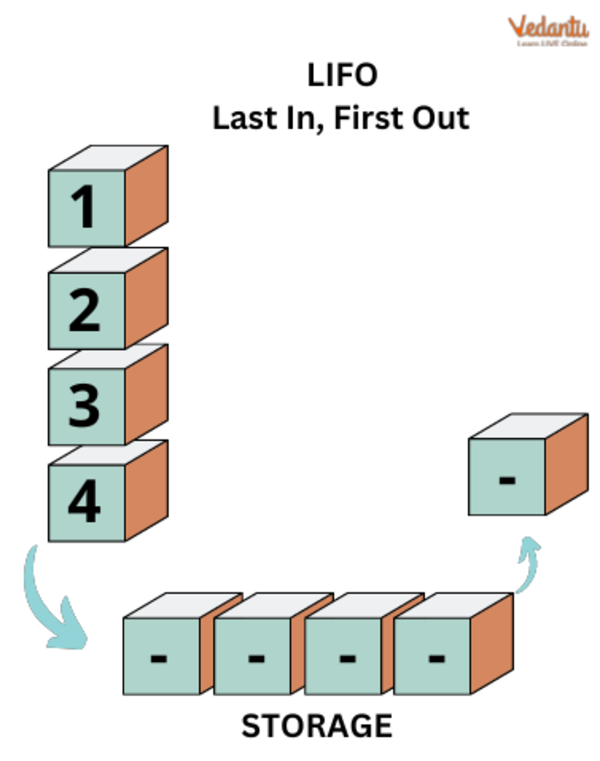

One way of calculating the costs of stock is called last-in, first-out (LIFO), which works on the premise that the most recent purchases will be the ones to be sold off first. When valuing a company's stock, the last-in, first-out (LIFO) technique requires that workers be reimbursed for the cost of goods at the price they were obtained.

That is until an entire lot of materials is used up, the LIFO system will continue to charge the most recent lot's purchase price. After that, the cost of the most recently available lot is added to the invoice for that task, division, or procedure. This means that some thick stock of materials will be retained.

They should be counted as the most current stock on hand when supplies are returned from the manufacturer to the storage area. The cost they were provided to the manufacturing facility must be reflected in the entry underneath the total number of units currently in stock on the materials ledger card.

Benefits of the Last-In, First-Out (LIFO) Method

Positives of Using LIFO (Last-In, First-Out)

The advantages of this approach include the following:

This strategy is also fast and easy to implement when prices are somewhat stable.

The most recent cost of purchased inputs is used to establish material costs in the manufacturing process.

In this scenario, the corporation may confidently and profitably quote prices for its products even as inflation rises.

This strategy is similar to FIFO. Produce a profit or loss that is not based on reality.

In cases when purchases are made regularly but not too often, this system is simple to implement.

Inflation's impact on manufacturing costs means looser budgeting and a smaller profit margin.

Knowing the Principle of Least Recently Used (LIFO)

Learning the Least Recently Used Principle (LIFO)

In the United States, all three inventory-costing procedures are permitted under generally accepted accounting principles, although last-in, first-out (LIFO) is the only one in common usage (GAAP). The LIFO approach is prohibited under the IFRS (International Financial Reporting Standards).

Companies with big inventories, such as department store ledger account LIFO method or car lots, often employ LIFO values, so they may take advantage of reduced taxes (when prices are increasing) and increased cash flows.

However, many American businesses use FIFO rather than LIFO since the latter reduces net income and profits per share when reporting financial results to shareholders.

Explain the concept of LIFO, or "last in, first out"

LIFO stands for "last in, first out," which you should explain

In inventory management, the most recently manufactured products are reflected as sold first using the LIFO approach. The higher cost of newer items will be reported as COGS, while the lower cost of older products will be recorded as inventory.

The LIFO method example technique first records sales of older inventory items. In contrast, the average cost method utilises a weighted average of all units sold throughout the accounting period to calculate COGS and ending inventory.

An inventory system uses the principle of "last in, first out" (LIFO).

The store ledger account LIFO method requires that the most recent purchases (or production) be expensed first.

Only in the United States, and following GAAP, is Last-In, First-Out (LIFO) employed (GAAP).

First-in, first-out (FIFO), and average cost are two more approaches to inventory accounting.

However, when prices are increasing, using LIFO might result in a tax benefit.

Example

Let's say that Mr. David opened a stationery store on February 1, 2019. He buys two registers that are the same from a wholesaler. Here are the things that were purchased in February and March 2019:

At the end of March, Mr. David learns he has sold 500 registers at $30 each. So, we now have to figure out how much the cost of goods sold and closing inventory was worth as of March 31, 2019.

Solution:

As the LIFO method is used to determine how much something is worth, the inventory bought last will be counted as having been sold first. This means that the cost should start with the registers bought on March 20, than those bought on March 5, and so on. Since the total number of items sold was only 500, the cost of goods sold should include the 50 items bought on February 15. The closing inventory comprises the remaining 150 units and the oldest inventory, which was bought on February 1.

Here is a table that shows how to figure out the cost of goods sold and the closing inventory as of March 31, 2019.

Value of Cost of goods sold:

Value of Closing inventory:

So, the cost of goods sold is worth 10,575 dollars, the closing inventory is worth 13,075 dollars, and the profit is Dollars4,425 (500 * 30 - $10,575).

Conclusion

Businesses determine the worth of their stock via the LIFO technique, which operates on the premise that the most recently acquired or manufactured things would be sold first, while the earlier acquired or manufactured items will sit unused. LIFO is one of three inventory costing techniques, the other being the LIFO method of inventory valuation. The LIFO approach works on the presumption that the pieces of merchandise that an organisation buys or produces during its production cycle are the ones that are moved.

FAQs on Learning the LIFO Method for Store Ledger

1. What exactly is the Last-In, First-Out (LIFO) method in accounting?

The Last-In, First-Out (LIFO) method is an inventory valuation technique where it's assumed that the last items added to inventory are the first ones to be sold. This means the cost of the most recently purchased goods is recorded as the cost of goods sold (COGS) first.

2. How does the LIFO method work with a simple example?

Imagine a store buys 10 pens at ₹5 each on Monday, and another 10 pens at ₹7 each on Tuesday. If the store sells 5 pens on Wednesday, under LIFO, it assumes the pens sold were from the Tuesday purchase. Therefore, the cost of goods sold would be calculated as 5 pens x ₹7 = ₹35. The remaining inventory would consist of the 10 pens from Monday and 5 from Tuesday.

3. What kind of businesses typically use the LIFO method?

The LIFO method is often used by businesses with large inventories that are not perishable and where individual units are hard to track. Common examples include:

- Automobile dealerships

- Department stores

- Retailers of commodities like coal or oil

4. What is the main difference between the LIFO and FIFO (First-In, First-Out) methods?

The primary difference lies in which costs are assigned to sold goods. Under LIFO, the cost of the newest inventory is used first. Under FIFO, the cost of the oldest inventory is used first. This leads to different values for both the cost of goods sold and the remaining inventory, especially when prices are changing.

5. Why would a company prefer the LIFO method during a period of rising prices (inflation)?

During inflation, the newest inventory is the most expensive. By using LIFO, a company matches these higher costs against its current revenue. This results in a higher reported cost of goods sold, which in turn leads to lower reported profits and, consequently, a lower income tax liability for that period.

6. Are there any major disadvantages to using the LIFO method?

Yes, there are a few key disadvantages. Firstly, it can present an outdated and unrealistic value for the remaining inventory on the balance sheet, as the costs are from older purchases. Secondly, LIFO is not permitted under International Financial Reporting Standards (IFRS), which limits its use for multinational companies. It can also be more complex to maintain LIFO records.

7. Does using the LIFO method mean the actual physical goods must be sold in that order?

No, this is a common misconception. LIFO is an accounting assumption about the flow of costs, not the physical flow of goods. A grocery store, for example, will physically sell its oldest milk first (FIFO) to avoid spoilage, but it could theoretically use the LIFO method for its financial reporting.